The following commentary on the use of machine learning and artificial intelligence use in the wealth management sector comes from F2 Strategy, the consultancy working with firms catering for high net worth and ultra-HNW clients. This news service has been sharing a number of F2’s insights about important topics; click here for a previous example.

The editors of this news service are pleased to share these thoughts and invite readers to respond. Jump into the conversation! The usual disclaimers apply to content from outside contributors. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Artificial intelligence , machine learning and predictive analytics have increased capabilities of companies in many industries and wealth management is no exception. While most industry firms are still at the threshold of possibility for this technology , key trends have already emerged. They will shape how firms adopt AI and ML over the next several years. Right now one thing is clear, firms must substantially increase their understanding of the technology and how it can support their long term-goals if they hope to scale while simultaneously providing a meaningful client experience.

F2 Research explored AI, ML and predictive analytics with 31 of the leading wealth management firms representing $7 trillion in assets under management. Here are two early trends it revealed:

Trend 1: The hurdles are high but not insurmountable

It is noteworthy that more than half of firms cite their institution’s lack of knowledge of AI and ML as an obstacle to adoption. Many firms say most employees don’t understand AI or ML and how it can make their work life better which slows progress. Additionally, more than a third of firms struggle to identify the return on investment and make the business case for AI/ML adoption. To increase knowledge, firms should start by looking for things they can predict and glean knowledge from their current data. As adoption advances, firms’ data analysts must understand the business practices behind the data to build effective models.

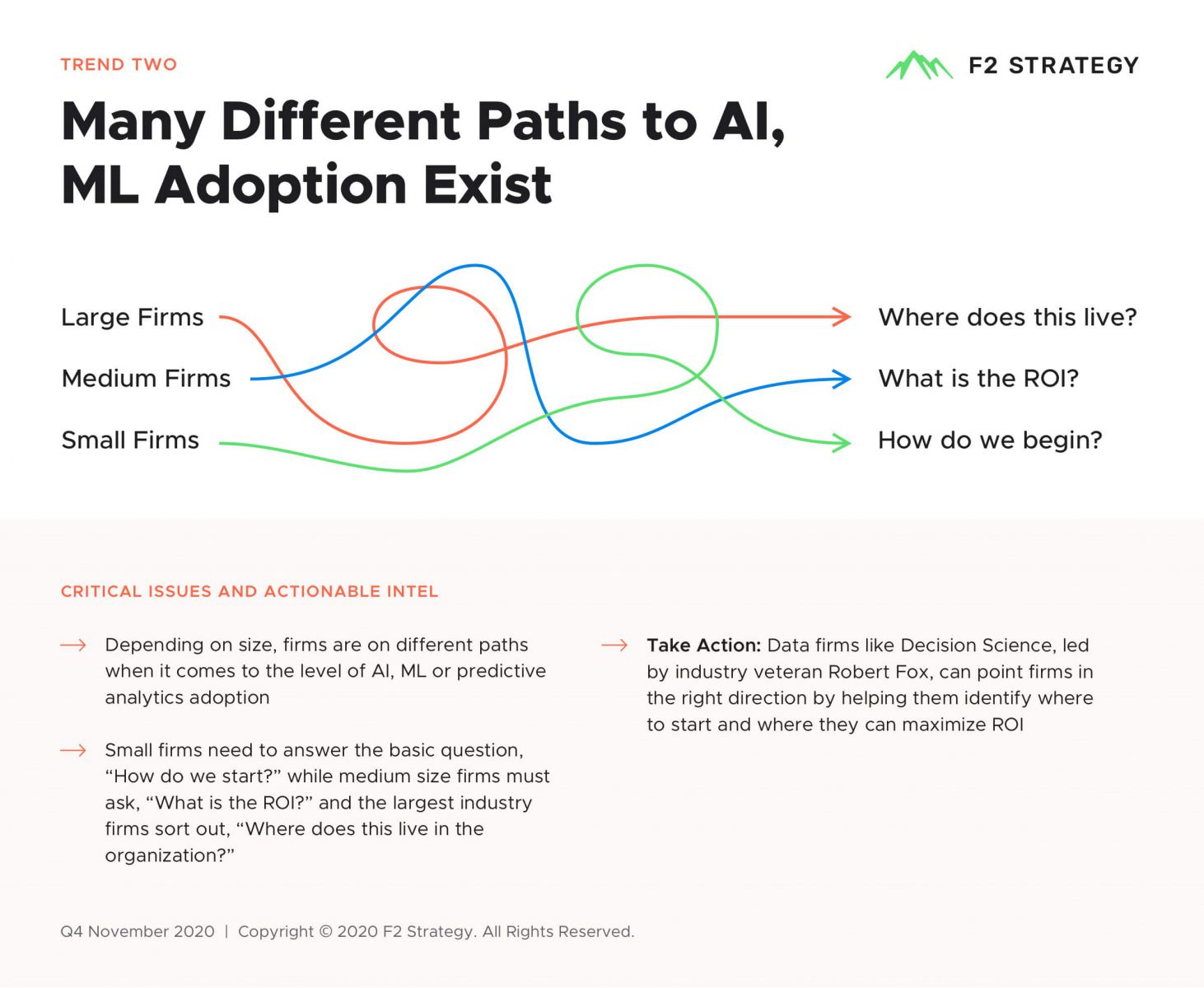

Trend 2: Many different paths to AI, ML adoption exist

The path to Al and ML adoption is not straight or even the same for every firm. Factors such as size put firms on different paths when it comes to the level and speed of AI, ML or predictive analytics adoption. Small firms need to answer the basic question, “How do we start?” while medium size firms must ask, “What is the ROI?” and the largest industry firms should sort out, “Where does this live in the organization?” But while the roads may be different, firms do not need to travel alone. Data firms like Decision Science, led by industry veteran Robert Fox, can point firms in the right direction by helping them identify where to start and where they can maximize return on investment.

Stay tuned for our Year in Review report later this month, where we will recap the top trends from this unprecedented year.

About F2 Strategy

F2 Strategy is a boutique management consulting firm helping complex RIA, wealth and multi-family office firms improve their technical capabilities across the entire client and advisor experience.